Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to provide the retail industry with Canadian credit and debit spending data and consumer insights that will help the industry more easily identify consumer behaviour and spending trends at the national and provincial level.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of December-February 2023

Overview

Retailers report a better finish to Holiday 2022 than expected, helping to smooth out a very uneven few months of consumer spending.

Fortunately, Boxing Day week was more than solid, for some making up for lost sales, for some making up for lost sales and then some. The year 2023 is starting uneven, somewhat based on the merchandise mix. Merchants are seeing a lack of demand for products either from a mild winter or because consumers bought-forward their commodities. There is a sense that consumers are either pulling back from retail spending due to financial constraints or shifting priorities. Conversely, apparel continues to do well – less growth in leisure and more in work/dress/formal, and anything travel related (luggage, warm-weather swimwear, for example) is solid, with retailers on average budgeting for low single digit year-over-year sales increases.

The overall perspective for 2023 is a softer first half but optimism for a better outlook for the back half of the year. Mileage will vary, however. First, we are comparing to COVID restriction numbers (unusual demand, stores restricted, artificially high online sales). Second, if you are a merchant of hard goods purchased extensively by consumers during the COVID era, demand is predictably soft, as will be year-over-year comp stores results without modification to the merchandise offering. This cautious optimism is reflected in capital spending budgets for 2023, which are holding steady as retailers continue to invest in significant technology upgrades (e.g., ERP) and their stores. Retail crime is a real concern and focus for retailers, with many reporting record high shrink, theft and violence in their stores. Those with credit facilities report higher rates of fraudulent applications, and all retailers report increases in the cybercrime threat environment.

Highlights from Winter December 2022 through February 2023 :

• 54% of respondents said sales were up versus 12 months prior

• 78% of respondents expected higher sales in 2023 than in 2022

• 42% report holiday sales were flat to expectations, 37% said holiday exceeded expectations

• 76% of respondents reported lower web sales than same time last year

• 55% expected their 2023 web sales to be higher than their 2022 web sales

• 50% of respondents saw lower margin percentages than last January

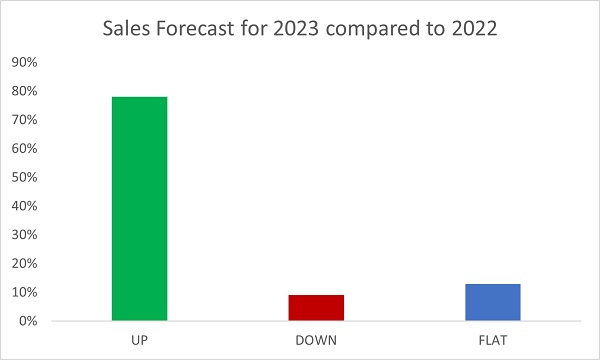

Budgets for 2023

When asked about budgets for 2023 versus 2022, most retailers, 78%, are planning to be ahead of 2022 numbers. This optimism is a mix of three things: a challenging start to 2022 with the COVID Omicron variant outbreak, actual and continued growth in the demand for their goods and services, and lastly, inflation.

Retailers of almost all formats report minor to significant cost increases from the vendors, increased cost of doing business (transportation, labour, utilities, security), and a weaker Canadian dollar versus the U.S. dollar. Overall, for many retailers on a unit basis, 2023 will be flat to slightly down net of inflation. On the optimistic side, retailers are looking for a near-return to tourism, continued apparel sales related to the workplace, an estimated 500,00 new Canadians, the majority of which are skilled or economic talent, and continued substantial employment numbers.

Pushing against these positive forces are higher mortgage rates coming due for homeowners, food inflation, diminished government programs, and diminished savings.

Consumer Behaviour

While there is still some “noise” in the numbers thanks to COVID-inspired restrictions last year, consumers continue to love physical retail stores, with 72% of retailers reporting increased traffic.

However, conversion is down in the stores versus the previous year. Still, this is compared against pandemic behaviours well documented of consumers being mission-oriented in their shopping. Retailers are happy to see the return of standard shopping patterns of browsing and impulse buying, and again are turning their minds to traffic drivers and soon to increasing conversions in the stores.

Online traffic and sales for most are down from last year, again comparing against COVID-era consumer behaviours. The percentage of sales sold online remains higher than pre-COVID numbers, but the pace of growth has returned to low double digits, overall channel shift. Shipping to stores is quite popular with consumers, curbside less so.

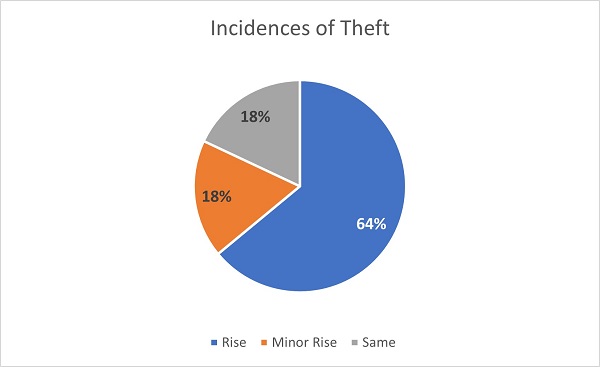

Focus on Retail Crime

For most, but not all, retail crime increased year-over-year; for those retailers, it was up versus pre-COVID. There was a range of responses, from no increase to a severe rise in crime to the degree that retailers might consider store closures. Retailers with credit cards or financing programs reported a surge in fraudulent applications.

Regarding cybercrime, retailers expressed concern and support for their fellow retailers dealing with the high-profile crimes reported in the media. All retailers are investing in prevention, some increases in investment being driven by insurance protocols or requirements, not unlike an ISO certification. Interestingly, retailers continue to re-examine their monitoring technologies, as there is a feeling that systems can deliver false positives.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. The sector annually generates over $78 billion in total compensation. Core retail sales (excluding vehicles and gasoline) were over $433B in 2021. Retail Council of Canada (RCC) members represent more than two-thirds of core retail sales in the country. RCC is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, we proudly represent more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants. www.retailcouncil.org.

Contact:

Santo Ligotti

Vice President, Marketing and Member Services

RETAIL COUNCIL OF CANADA | CONSEIL CANADIEN DU COMMERCE DE DÉTAIL

sligotti@retailcouncil.org

Interested in membership, then please visit retailcouncil.org or contact membership@retailcouncil.org