When the province entered Phase 1 of its reopening plan on June 11, 2021, Ontarians spent the weekend dining at patios, attending outdoor fitness classes, shopping at non-essential retailers, and making trips to wine country and cottage country.

Overall

- Across the province there was a 33% increase in sales volumes week-over-week

- There was a 43% increase in retail and 48% increase in restaurants as non-essential retail and patios reopened in Phase 1

- The highest increase in retail spending was in Halton at 70% over the previous week

- Halton also had the highest increase in sales volumes (56%) for the province

- The highest increase in restaurant spending was in Toronto at 73% over the previous week

Top 3 Retail Categories

1. Department stores: 713% increase

2. Apparel: 609% increase

3. Household: 108% increase

Recreation and Travel

- Gyms and studios saw a 17% increase with the launch of outdoor classes

- Certain regions also saw significant increases in hotels in Hamilton (139%), Niagara (124%), Prince Edward (21%), Simcoe (18%), Waterloo (66%) and Wellington (56%), with some Ontarians jumping at the first opportunity in a long time for a weekend getaway.

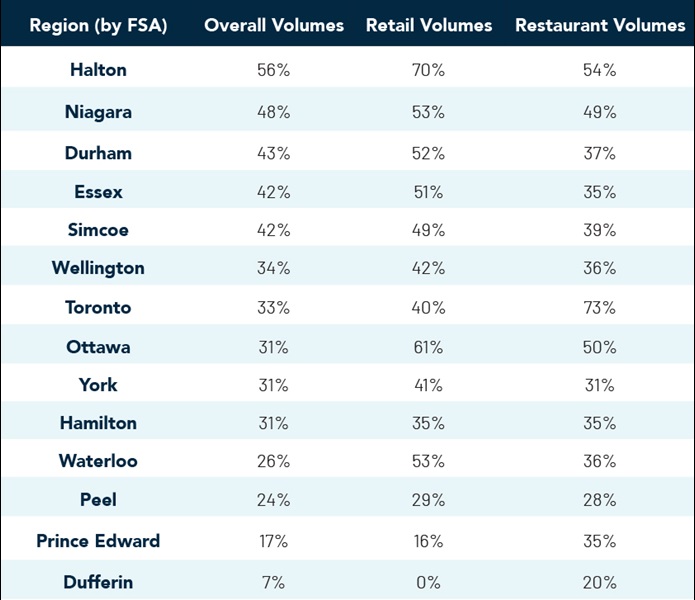

Spending Volumes by Region

About the data: Ontario Reopening Phase I data is based on the transaction volumes for the weekend of June 11-13, 2021 as compared to the week prior of June 4-6, 2021. Moneris spending reports measure spending in Canada across a range of categories by analyzing credit and debit card transaction data. The figures and percentages cited are derived from aggregated transaction volumes being processed by Moneris in the applicable categories.

Regional Breakouts

Dufferin

- 7% increase in volumes overall

- 20% increase in volumes at restaurants

- 32% increase in mass merchandisers (variety stores)

Durham

- 43% increase in volumes overall

- 52% increase in retail

- 37% increase in restaurants

- 11% increase in golf courses (public)

Essex

- 42% increase in volumes overall

- 51% increase in retail

- 35% increase in restaurants

Halton

- 56% increase in volumes overall – highest in the province

- 70% increase in retail – highest in the province

- 54% increase in restaurants

- 15% increase at gyms and studios

Hamilton

- 31% increase in volumes overall

- 35% increase in retail

- 35% increase in restaurants

- 13% increase in golf courses (public)

- 139% increase in hotels

Niagara

- 48% increase in volumes overall

- 53% increase in retail

- 49% increase in restaurants

- 33% increase in gyms and studios

- 124% increase in hotels

Ottawa

- 31% increase in volume overall

- 61% increase in retail

- 50% increase in restaurants

- 14% increase in gyms and studios

- 12% increase in golf courses (public)

Peel

- 24% increase in volume overall

- 29% increase in retail

- 28% increase in restaurants

- 13% increase in gyms and studios

- 10% increase in golf courses (public)

Prince Edward

- 17% increase in volume overall

- 16% increase in retail

- 35% increase in restaurants

- 21% increase in hotels

Simcoe

- 42% increase in volume overall

- 49% increase in retail

- 39% increase in restaurants

- 18% increase in hotels

- 20% increase in gyms and studios

Toronto

- 33% increase in volumes overall

- 40% increase in retail

- 73% increase in restaurants – highest in the province

- 15% increase in gyms and studios

Waterloo

- 26% increase in volumes overall

- 53% increase in retail

- 36% increase in restaurants

- 66% increase in hotels

- 12% increase in golf courses

Wellington

- 34% increase in volumes overall

- 42% increase in retail

- 36% increase in restaurants

- 56% increase in hotels

York

- 31% increase in volumes overall

- 41% increase in retail

- 31% increase in restaurants

- 35% increase in gyms and studios

Interested in getting rich and timely consumer spending data to make smarter strategic decisions? Easily support your new or ongoing policies, research, and forecasting models with Moneris Data Services.