In partnership with Moneris® Data Services, the Angus Reid Group conducted an online survey among a representative sample size of 1,515 adult Canadians to characterize their spend behaviours in response to these economic influences. Questions answered in this report are:

Looking back

In what ways did consumer behaviour evolve during the pandemic?

Today

As we navigate a post-pandemic economy, how has consumer behaviour changed?

Looking ahead

How will Canadians adjust their spending with new economic pressures like rising inflation?

Let’s explore the findings.

Looking back

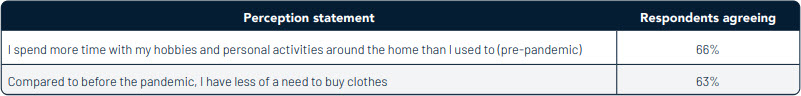

When asked, most Canadians indicated that they spent more time pursuing hobbies and activities around their home through the pandemic. Complimentary to that, Canadians also found they had less of a need to re-stock their wardrobe. As we navigated the new normal, Canadians likely revamped their attire to reflect work from home and fewer in-person events to attend.

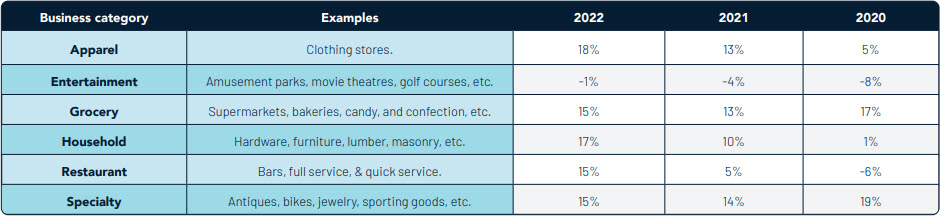

The spend within the Household group increased by 18% while other categories saw a decrease. Relatively unchanged were things essential to everyday life, like das and Convenience, as well as groceries. Meanwhile, we see a meaningful decrease in transaction count, which was observed for apparel, entertainment, restaurants, and specialty, possibly due to reduced consumer confidence and hampered desire from restrictions.

Comparing average transaction size (ATS) between 2020 and 2019, Canadians hunkered down to weather-out lockdowns and restrictions. Possibly motivated to reduce the number of trips and make the most of each one, the average transaction size went up 17% for groceries.

Today

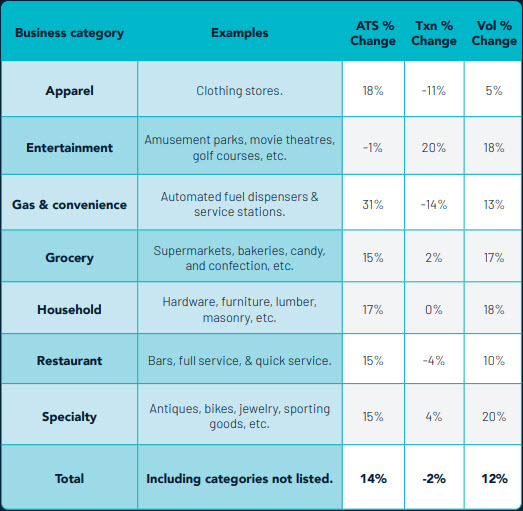

Overall, consumer spending has returned to pre-pandemic levels, even improving as volume is up 12% when comparing spend in July 2022 versus July 2019. However, the return is driven largely by an increase in average transaction size, up 14%, rather than transaction count, down at -2%.

Contrary to Canadian perceptions, while 67% believe they are purchasing/doing less, transaction counts are up 20%. As restrictions lift many are also eager to enjoy entertainment experiences that were not possible during the pandemic.

Looking ahead

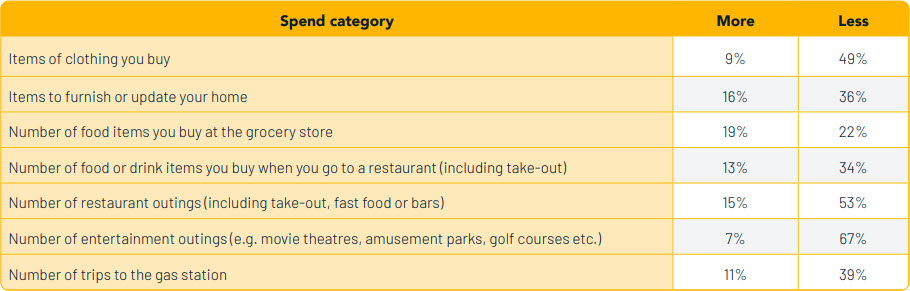

In contrast to trends during pandemic, where clothing was an area Canadians cut back on, it now appears to be far from their first choice on where to save. One possible explanation is that Canadians have already saved what they can in this category during the pandemic.

Rather than spend additional disposable income on more discretionary experiences, Canadians would rather allocate it to offset the rising cost of living. Along the same vein is directing the additional funds back into the home, which aligns as many Canadians opt to continue working

from home.

The shifting spend priorities of Canadian consumers

Spend data

Figures are based on a comparison to the same period in the year prior. The period selected for this data set is July 2022, 2021, 2020, and 2019. Moneris reports measure spending in Canada across a range of categories by analyzing credit and debit card transaction data. The figures cited are derived from aggregated and anonymized transaction data being processed by Moneris in the applicable categories.

Survey methodology

In partnership with Moneris, the Angus Reid Group conducted an online survey among a representative sample of n=1,515 adult Canadians. The respondents are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2.5 percentage points, 19 times out of 20.

Introduction

From the pandemic and lockdowns to supply chain disruptions and rising inflation, the past few years have been eventful for Canadian consumers and the economy.

With these factors at play, questions surrounding their economic impact are top-of-mind. To provide answers, analyzing transaction data and the sentiment of Canadians as they reflect on the past few years make the identification and interpretation of trends possible.

Through research conducted by Moneris and Angus Reid, findings presented within this report help capture the pulse of Canadian consumers and characterize their spend behaviours in response to these economic influences. Questions answered in this report are:

Looking back

In what ways did consumer behaviour evolve during the pandemic?

Today

As we navigate a post-pandemic economy, how has consumer behaviour changed?

Looking ahead

With new economic pressures like rising inflation, how will Canadian’s adjust their spending?

To what extent do you agree…

New normal, new you

When asked, most Canadians indicated that through the pandemic they spent more time pursuing hobbies and activities around their home.

Complimentary to that, Canadians also found they had less of a need to re-stock their wardrobe. As we navigated the new normal, Canadians likely revamped their attire to reflect work from home and fewer in person events to attend.

These perceptions of Canadians are also reflected in transaction data captured over the pandemic.

Sample of business categories comparing transaction count each year to 2019

Substitution Spend

Comparing transaction count between 2020 and 2019, essentials became evident, and so did consumer choices for substitution spend. With restrictions impacting what Canadians were able to purchase, spend within the Household group increased by 18% while other categories saw a decrease.

Relatively unchanged were groups essential to everyday life, like Gas and Convenience, as well as Grocery. Meanwhile, we see a meaningful decrease in transaction count, which was observed for Apparel, Entertainment, Restaurant, and Specialty, possibly to do with reduced consumer confidence and hampered desire from restrictions.

Sample of business categories comparing average transaction size each year to 2019

Stocking up

Comparing average transaction size (ATS) between 2020 and 2019, Canadians hunkered-down to weather-out lockdowns and restrictions. Possibly motivated to reduce the number of trips and make the most of each one, average transaction size went up 17% for Grocery. Through the pandemic, and as mentioned before, Canadians took the opportunity to take-up hobbies and explore their interests, possibly contributing to a 19% increase in ATS for Specialty. At the same time, lockdowns and restrictions may have dampened spend for Entertainment and Restaurant.

Spend is back, but not quite the same

Overall, consumer spending has returned to prepandemic levels, even improving as volume is up 12% when comparing spend in July 2022 versus July 2019. However, the return is driven largely by an increase in average transaction size, up 14%, rather than transaction count, down at -2%.

The nuance of this return is also present in the survey response of Canadians as they reflect on their spend behaviour compared to before the pandemic. At a high-level, respondents to the survey indicated they were doing/purchasing less, in contrast to what the spend data shows.

Comparing the spend and survey data, the primary explanation is likely the impact of rising inflation. For spend data, this presents itself through an increase in average transaction size. Meanwhile, in the survey data, Canadians may perceive they are doing/purchasing less as their dollar no longer carries the same purchasing power.

Spend data for a sample of business categories comparing July 2022 to July 2019

Would you say that you’re doing/purchasing more or less than before?

Some differences from the spend data

Most perceptions of spend are roughly in align with spend in practice. For example, where Canadians perceive to be spending less, transaction counts are also below pre-pandemic levels – groups like Apparel, Gas and Convenience, as well as Restaurant for example.

Contrary to Canadian perceptions, however, is spend related to entertainment. While the 67% believe they are purchasing/doing less, transaction counts are up 20%. Entertainment is a broad topic. Although we may believe or even wish to spend less on discretionary categories, spend on entertainment still contributes significantly to the lifestyle of Canadians. In addition, as restrictions lift many are also eager to enjoy entertainment experiences that were not possible during the pandemic.

Bargains over breaking the bank

Looking for deals and opportunities to save are nothing new, however, given the stress Canadians are feeling about their financial future there is a clear message for businesses. If they want to grab the attention of consumers, deals/sales may be the best way to do it. Especially as businesses also need to overcome the consumer’s desire to save.

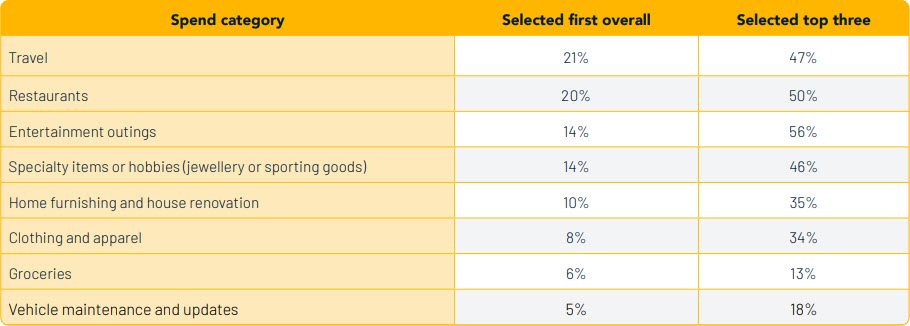

If you had $1,000 less, what would you cut back on?

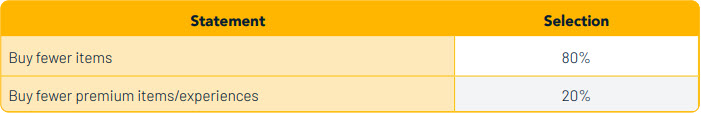

Based on your first choice are you more likely to…

In search of savings

Elevated inflation means a higher cost of living for Canadians. When characterizing reduced buying power as having $1,000 less to spend, areas like travel, restaurant, and entertainment were where respondents looked to economize. Meanwhile, more essential, and everyday items like clothing, groceries, and vehicle maintenance were less likely to be selected.

In contrast to trends during pandemic, where clothing was an area Canadians cut back on, it now appears to be far from their first choice on where to save. One possible explanation is that Canadians have already saved what they can in this category during the pandemic, which still has some room to improve.

When asked how Canadians would cut back, the vast majority responded with managing quantity over quality.

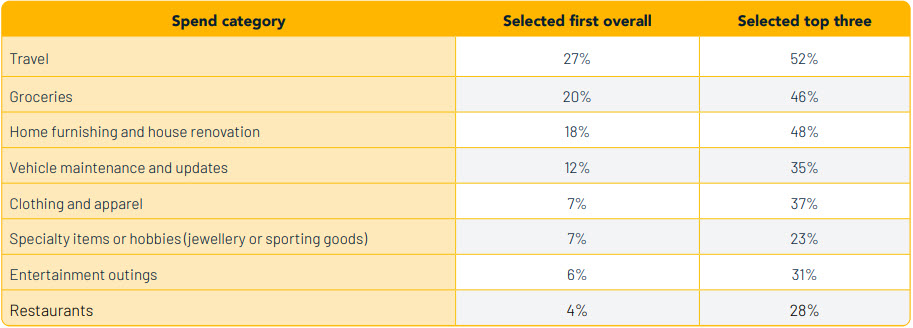

If you had an extra $1000, where would you spend it?

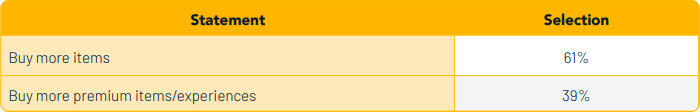

Based on your first choice are you more likely to…

Combating the cost of living

Travel as a first choice is to be expected. What might be unexpected is how high grocery placed. Rather than spend additional disposable income on more discretionary experiences, Canadians would rather allocate it to offset the rising cost of living. Along the same vein is directing the additional funds back into the home, which aligns as many Canadians opt to continue working from home.

When asked how Canadians would spend an additional $1,000, they again selected more quantity over more quality.

About Moneris

Moneris is Canada’s largest provider of innovative, unified solutions for mobile, online and in-store payments, processing more than one in three transactions. Serving businesses of every size and industry, Moneris offers hardware, software and solutions to help transform the way businesses grow and operate, in payments and beyond.

About The Angus Reid Group

Angus Reid is Canada’s most well-known and respected name in opinion and market research data. Offering a variety of research solutions to businesses, brands, governments, not-for-profit organizations and more, the Angus Reid Group team connects technologies and people to derive powerful insights that inform your decisions.

Data is collected through a suite of tools utilizing the latest technologies. Prime among that is the Angus Reid Forum, an opinion community consisting of engaged residents across the country who answer surveys on topical issues that matter to all Canadians.