As part of our latest partnership with the Conference Board of Canada we are pleased to present the following authoritative insights from their Index of Consumer Spending (ICS) which has been Powered by Moneris® Data Services. Our industry-leading consumer spending data and insights from point-of-sale activity combined with The Conference Board of Canada’s expertise provides a coast-to-coast perspective on how the economy is trending.

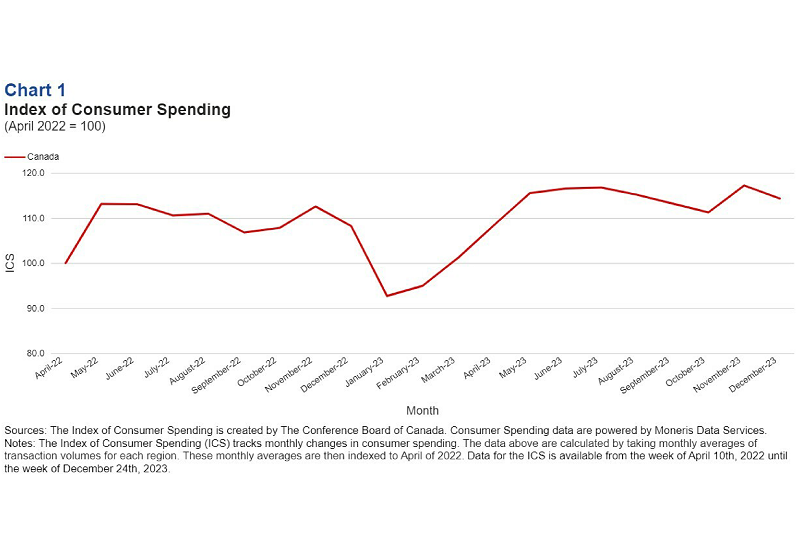

- Consumer spending fluctuated in the final quarter of 2023 but was ultimately weaker than in the summer months. The index of consumer spending (ICS) fell to 111.2 points in October, reached 117.2 points in November, but retreated to 114.3 points in December.

- On a year-over-year basis, the ICS averaged 4 per cent higher in the fourth quarter of last year compared to 2022.

- Inflation has been trending down but remains stubbornly above the Bank of Canada’s target range. The national inflation rate rose to 3.4 per cent in December and households across the country are still grappling with higher food and shelter costs. Rental prices and mortgage interest costs, in particular, continue to take a large bite out of household budgets.

- The latest labour force survey showed that job growth was muted in December. On net, the Canadian economy added around 42,500 jobs in the fourth quarter of 2023—less than half the job gains recorded in the third quarter.

Key Insights

The battle to tame inflation is far from over.

The national inflation rate has been trending down since the summer of 2022, but the final stretch to reach 2 per cent inflation is proving to be difficult. December saw an uptick in inflation, driven by a higher year-over-year price of gasoline, though price hikes for food and shelter were also elevated. Complicating matters further, wage growth has remained robust, fueling some concerns over a wage-price spiral. Stubbornly high inflation means that Canadians will have to endure higher rates for a while longer. In our view, interest rates will start coming down in June of this year.

Higher interest rates will continue to permeate the Canadian economy.

Real household consumption has been essentially flat since the first quarter of 2023. Aggregate spending would have declined further had there not been a surge in population. On the other hand, real spending per capita is declining and this trend will likely continue throughout most of 2024. The burden of higher mortgage interest costs and increased grocery prices continues to weigh on household finances. In fact, only about one-third of Canadian mortgage holders have renewed their mortgages at higher rates. Households that have not renewed their mortgages may be exercising caution in their spending, anticipating forthcoming increases in mortgage expenses. Even non-mortgage holders are not immune to financial pressure, as rents have risen significantly on a year-over-year basis. Overall, the impact of higher interest rates has contributed to a deceleration in economic activity. Despite these challenges, we are still predicting a soft landing.

About The Conference Board of Canada:

The Conference Board of Canada is the country’s leading independent research organization. Our mission is to empower and inspire leaders to build a stronger future for all Canadians through our trusted research and unparalleled connections. Index of Consumer Spending | The Conference Board of Canada.

Media Contacts:

The Conference Board of Canada

media@conferenceboard.ca / 613-526-3090 ext. 224

media@moneris.com / 416-734-1442

Walter Bolduc

Economist

bolduc@conferenceboard.ca