November and December are the busiest shopping months of the year. While businesses gear up for the holiday rush, consumers eagerly anticipate the best deals in store and online.

This year, consumers are all set to get into the festive spirit and splurge during the holidays. Moneris Spend data predicts that the 2023 holiday season will be an economically prosperous time for the retail industry as spending approaches pre-pandemic levels.

Here are some key insights from this year’s Black Friday and Cyber Monday (BFCM) weekend to empower retailers in Canada so that they can prepare for the busy season ahead as well as what’s to come in the New Year.

The Busiest Day versus the Busiest Season

Traditionally, the BFCM weekend has been considered a make-or-break for retailers. But slowly, the emphasis on shopping only on those two days has reduced. Moneris Spend data suggests that shoppers tend to make purchases throughout the week leading up to BFCM.

What does this mean for retailers gearing up for Christmas? You’ll need to consider a more extended approach to capitalize on the entire holiday season. From promotional deals and discount vouchers to loyalty rewards, retailers must provide attractive offers with longevity beyond the BFCM weekend to boost sales and stay ahead of their competitors.

Over the Holidays, How Busy is Busy?

Drawing from 2023’s holiday season spend data, businesses can gain valuable insights into consumer spending behaviour around the holiday season. Understanding the patterns of consumer behaviour during this period can help retailers prepare for the influx of shoppers and their needs, and strategically plan to maximize revenue.

A Closer Look at Spend Across Canada

Not all provinces and territories spend the same. Moneris spend data highlights regional differences and specific insights for each province during the holiday season. Retailers can leverage this information to tailor their marketing efforts and strategies to align with specific spending patterns, preferences, and cultural nuances based not only on physical store locations but also where their customers are based.

Consumer Spend in Five Major Cities in Canada

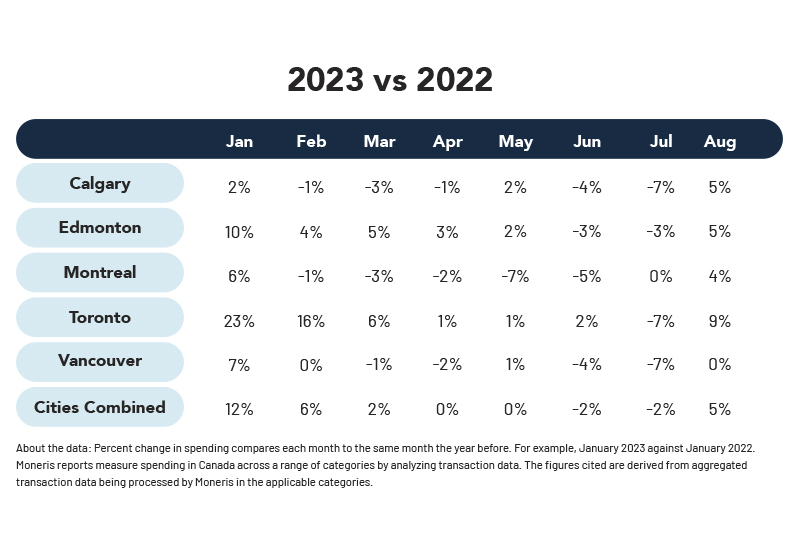

Let’s step out of the 2022 holiday season to look at retail volume by month to see how the industry is tracking year-over-year through 2023 in five major cities in Canada—Calgary, Edmonton, Montreal, Toronto, and Vancouver.

- In January 2022, spending increased compared to the previous year, despite ongoing COVID restrictions. As the summer of 2022 unfolded and most restrictions were lifted, a clearer picture of recovery emerged.

- Various factors influenced spending trends during this period, including return to office mandates, increased travel, and a focus on cost-conscious consumer behavior.

- June and July experienced decreases in spending, potentially influenced by the vacation season, with Canadians directing their spending outside the country.

- In contrast, spending rebounded in August, possibly due to the winding down of the vacation season and back-to-school preparations.

- The beginning of 2023 witnessed a rebound in retail spending. However, a comparison with the previous summer revealed a dip, making the upcoming holiday season particularly crucial for retailers to capitalize on potential opportunities.

Summary

As the holiday season approaches, retailers in Canada can understand the evolving dynamics of consumer behavior, regional variations, and the changing significance of key shopping days. Businesses can craft targeted strategies that resonate with their target audience to not only survive but thrive in this festive retail environment.

Access to real-time Canadian consumer spending and location data with Moneris Data Services.