Step 3 of Ontario’s reopening began on July 16, 2021. There was a moderate increase at restaurants with the return of indoor dining but tourist attractions, recreational sports leagues, and gyms were where Ontarians spent the most money.

Overall

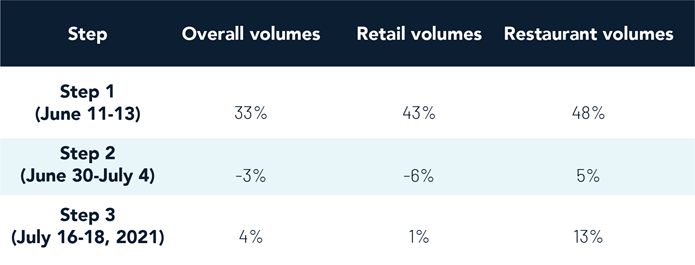

• Across the province volumes continue to climb although at a slower pace week-over-week (4%) compared to the first big opening at Step 1.

• Retail levels remained essentially the same week-over-week (1%) but spending at restaurants continued to climb with a 13% increase during the first weekend of indoor dining.

• The real winners of Step 3 were tourist attractions, recreational sports leagues, and gyms:

348% week-over-week increase at tourist attractions and exhibits (zoos, museums, tours, etc.)

187% week-over-week increase at commercial sports (recreational sports leagues, sports camps, etc.)

77% week-over-week increase at gyms and studios

Week-over-week Volume Comparisons for Ontario

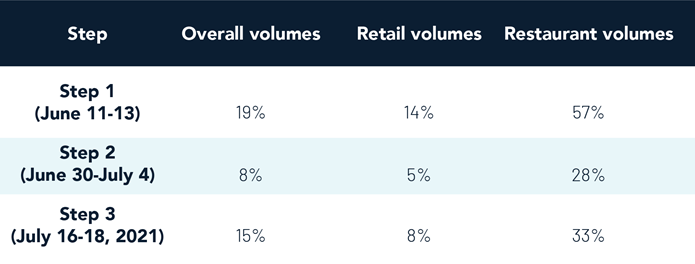

Year-over-year Volume Comparisons for Ontario

Regional Breakouts – Week-over-week Volumes

Dufferin

• 9% increase in volumes overall

• 7% increase in volumes at retail

• 11% increase in volumes at restaurants

Durham

• 1% increase in volumes overall

• 12% increase in volumes at restaurants

• 17% increase in volumes at gyms and studios

• 27% increase in volumes at car rentals

Halton

• 2% increase in volumes overall

• 12% increase in volumes at restaurants

• 10% increase in volumes at gyms and studios

• 17% increase in volumes at car rentals

• 2482% increase in volumes at recreational sports leagues and camps

Hamilton

• 1% increase in volumes overall

• 9% increase in volumes at restaurants

• 25% increase in volumes at hotels

• 259% increase in volumes at car rentals

• 160% increase in volumes at recreational sports leagues and camps

• 211% increase in volumes at gyms and studios

Niagara

• 1% increase in volumes overall

• 6% increase in volumes at restaurants

• 24% increase in volumes at hotels

• 43% increase in volumes at car rentals

• 241% increase in volumes at gyms and studios

• 374% increase in volumes at tourist attractions and exhibits

Ottawa

• 6% increase in volumes overall

• 11% increase in volumes at restaurants

• 102% increase in volumes at recreational sports leagues and camps

Peel

• 0% increase in volumes overall

• 16% increase in volumes at restaurants

• 314% increase in volumes at gyms and studios

• 636% increase in volumes at recreational sports leagues and camps

Simcoe

• 4% increase in volumes overall

• 3% increase in volumes at retail

• 10% increase in volumes at restaurants

• 41% increase in volumes at car rentals

• 40% increase in volumes at gyms and studios

Toronto

• 8% increase in volumes overall

• 3% increase in volumes at retail

• 15% increase in volumes at restaurants

• 222% increase in volumes at gyms and studios

• 188% increase in volumes at tourist attractions and exhibits

• 234% increase in volumes at recreational sports leagues and camps

Waterloo

• 7% increase in volumes overall

• 4% increase in volumes at retail

• 13% increase in volumes at restaurants

• 78% increase in volumes at hotels

• 327% increase in volumes at gyms and studios

Wellington

• 0% increase in volumes overall

• 18% increase in volumes at restaurants

• 28% increase in volumes at hotels

York

• 4% increase in volumes overall

• 4% increase in volumes at retail

• 12% increase in volumes at restaurants

• 49% increase in volumes at gyms and studios

• 291% increase in volumes at recreational sports leagues and camps

Interested in getting rich and timely consumer spending data to make smarter strategic decisions? Easily support your new or ongoing policies, research, and forecasting models with Moneris Data Services.

About the data: Week-over-week Ontario Reopening Step 3 data is based on the transaction volumes for the weekend of July 16-18, 2021 as compared to the week prior of July 9-11, 2021. Year-over-year volumes are based on a comparison to the same period in the year prior. Moneris spending reports measure spending in Canada across a range of categories by analyzing credit and debit card transaction data. The figures and percentages cited are derived from aggregated transaction volumes being processed by Moneris in the applicable categories.