As part of our latest partnership with the Conference Board of Canada we are pleased to present the following authoritative insights from their Index of Consumer Spending (ICS) which has been Powered by Moneris® Data Services. Our industry-leading consumer spending data and insights from point-of-sale activity combined with The Conference Board of Canada’s expertise provides a coast-to-coast perspective on how the economy is trending.

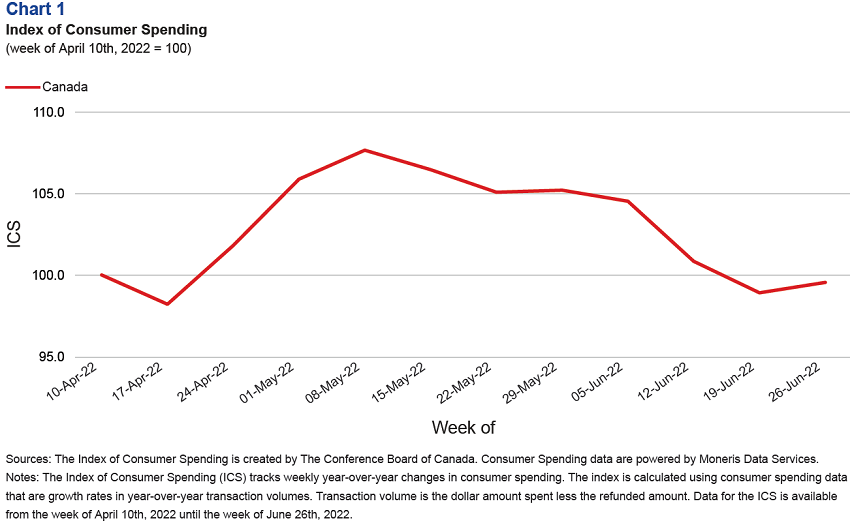

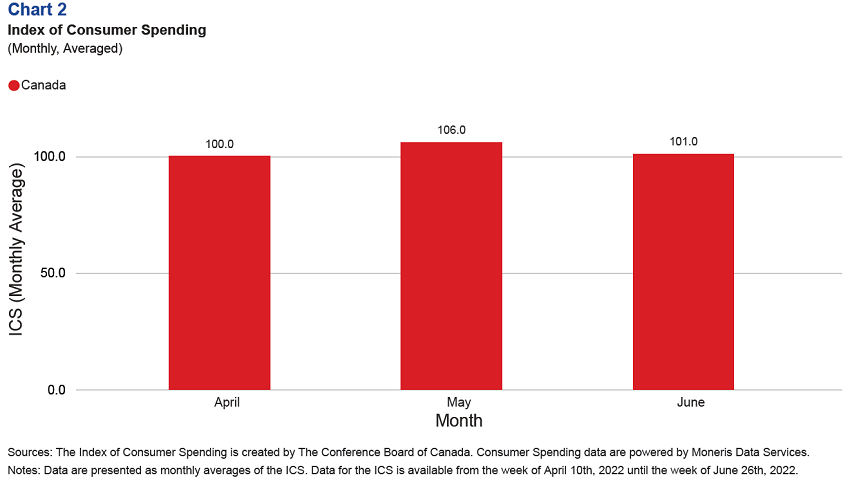

• Growth in consumer spending has been trending downwards in recent weeks. The Index of Consumer Spending (ICS) averaged 100 points in April, 106 points in May, and 101 points in June.

• The drop in June’s ICS indicates that year-over-year consumer spending growth slowed.

• Persistent inflation has caused consumers to feel less optimistic about their current and future financial situations.

• Canadians are spending more on energy and gasoline, which has resulted in a change in retail buying behaviour.

• The national unemployment rate fell to 4.9 per cent in June –a historic low. Consumer spending would have been much weaker had the labour markets not been so tight.

Key Insights

There are signals in the consumer spending data that suggest Canadians are adjusting their budgets to deal with inflation.

A strong labour market has given Canadians the confidence to spend while accumulated savings are acting as a buffer for inflation. However, inflation has been on the rise for many months now and consumers are finding it difficult to cope. As a result, a decline in year-over-year consumer spending growth was recorded in June.

Higher interest rates will cool customer behaviour in the coming months.

Canadians are paying more for a basket of goods in 2022 than in 2021. Supply chain bottlenecks, excess demand for goods and services, and geopolitical tensions have all contributed to the rise in prices we are witnessing. The Bank of Canada has acted aggressively to tackle inflation by raising the target for the overnight rate by 100 basis points to 2.5 per cent in July. The Bank has also indicated that further increases are imminent. As rate increases begin to work their way through the economy it is expected that economic activity will begin to cool in the coming months.

Consumer savings will soften the blow of interest rate hikes.

Rising interest rates and high inflation are both acting to slow the pace of consumer spending growth, but an offsetting factor is the cushion of accumulated savings that many have built up over the past two years. Government support programs and reduced spending post-pandemic allowed the household savings rate to soar to a 30-year high, and it remains above pre-pandemic norms. This translates into tens of billions of dollars of additional potential spending capacity.

Canada’s strong labour market continues to be a high point.

The unemployment rate fell to a record low of 4.9 per cent in June. As well, job creation has been robust over the past year, job vacancies are at a record high, and wage growth is accelerating. In short, Canada’s labour market is as tight as it has ever been, and that is also supporting the pace of growth in consumer spending.

Pandemic-related restrictions have induced pent-up demand for high-contact services.

Now that most public health restrictions have been lifted, we expect that Canadians will spend more on travel-related services throughout the summer months. It is also anticipated that spending on food, accommodations, and entertainment will remain strong throughout the rest of 2022. However, many consumers will likely delay purchasing durable goods during this period of high inflation.

About The Conference Board of Canada:

The Conference Board of Canada is the country’s leading independent research organization. Our mission is to empower and inspire leaders to build a stronger future for all Canadians through our trusted research and unparalleled connections. Index of Consumer Spending | The Conference Board of Canada.

Media Contacts:

The Conference Board of Canada

media@conferenceboard.ca / 613-526-3090 ext. 224

media@moneris.com / 416-734-1442

David Ristovski

Economist

ristovski@conferenceboard.ca

MONERIS and MONERIS & Design are registered trademarks of Moneris Solutions Corporation. All other marks or registered trademarks appearing on this page are the property of their respective owners.