Imagine an industry booming and striving uninterruptedly for decades and suddenly coming to a halt. The pandemic impacted all industries hard, but crash landed on the travel industry. Pilots were laid off, airplanes sat parked on tarmacs, hotels sat empty–COVID 19 was more sinister than expected.

Many businesses were forced to reassess their marketing tactics and came up with strategies to shift online to continue to offer a satisfactory shopping experience to their customers. But the tourism industry had no such luck. With travel restrictions in place, the aviation and hospitality sectors bore great losses during COVID.

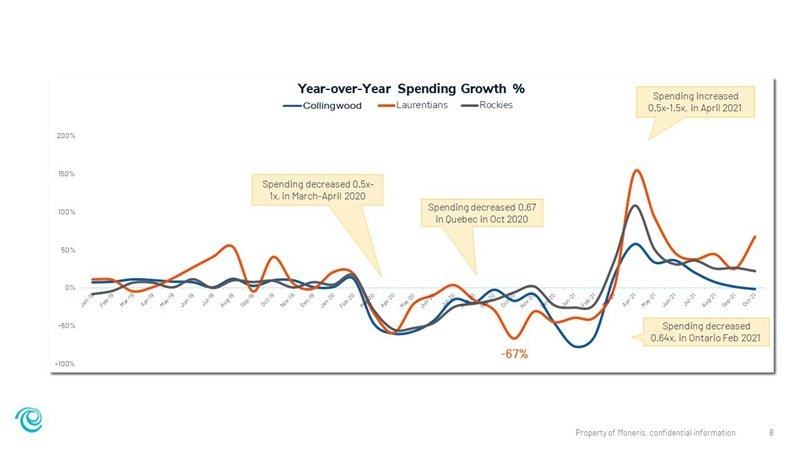

However, with things slowly getting back to normal or adapting to the ‘new normal,’ businesses are picking up pace. To understand consumer spending trends during the pandemic and how they’ve changed with the ease of restrictions, Moneris® Data Services examined tourism and consumer spending trends among Canadians prior-to and during COVID, from January 2019 to December 2021. For this study, a comparison in the consumer buying behavior was done between three mountain destinations–the Rockies, Collingwood, and the Laurentian mountains–popular tourist attractions both in the summer and winter months.

Let’s dive into the key findings of the report.

Consumer Spending Trends Among Canada’s Top Mountain Destinations

- COVID’s impact was the deepest during peak lockdown periods in March-April 2020, and Jan-Feb 2021

- Visitors shopping and staying in these tourist regions prior-to and during COVID made less transactions overall than they spent, meaning the trend was to spend more and make fewer trips

- Following easing of lockdowns in early 2021, the Hotel and Entertainment sectors had the largest spending increases starting in March 2021 and moving into the summer

- Ontario, Quebec, and Western travelers spent more in their home provinces during COVID in 2020

- COVID caused decline in average spend during 2020 but was seen as recovering in 2021 and into 2022

Rockies Consumer Spending:

- Steeper decline in overall consumer spending in March 2020 occurred due to fewer visitors

- The average spend was high in both Winter and Summer 2021 after COVID suggesting price increases and more acute spending patterns

- Consumer spending decreased by 60% in April 2020 but recovered by 57% in March 2021

- Retail transactions increased 0.4x-0.9x in April 2021

- Recovery in spend was higher in Summer 2021 as opposed to the winter which is perceived as an off-season for the Rockies but is actually very important

- Decline in spending in 2020 due to fewer international tourists was mitigated in Summer 2021 with more domestic visitors

- Higher spending came from Alberta and British Columbia in 2020

- The average nights stayed is mostly unchanged for the Rockies before and during pandemic

Laurentians Consumer Spending:

- Consumer spending decreased 0.43x in Quebec in October 2020 and increased 0.5x-1.5x in April 2021

- Consumer spending was higher in the summer than in the winter

- The heavy dependency on domestic visitors in terms of consumer spending in the Laurentians compared to other places like the Rockies, occurs because fewer international visitors with almost none in Quebec in 2021

- Transactions in winters are less overall than in the summer season

- The average money spent per customer in Laurentians collapsed in 2020 but is recovering in Summer 2021

- Decline in consumer spending in 2020 occurred with those from the West, while higher spending came from Quebec

- The average nights stayed have been constantly increasing in Laurentians

Collingwood Consumer Spending:

- Consumer spending decreased 0.77x in Ontario February 2021

- Blue Mountains still has the opportunity to grow its recovery following COVID

- Collingwood had more of a decrease in transactions in January 2021 and less of a recovery in April 2021

- While volume is recovering, the average spend is still lower than pre-COVID

- Transactions are much lower than spend

- Collingwood captured mostly Quebec travelers during COVID

- The average nights stayed have been slowly going up in Collingwood

Mountain destinations in Canada have seen some strong recovery post COVID. As international travel still remains less preferable, domestic Canadian travelers are flocking to local destinations to take a break from work and of course to save themselves the hassle of getting COVID tests done for international travel. While domestic travel has resumed, it can only cover a fragment of losses from overseas tourism. Merchants and tourist destinations should consider driving and attracting continued domestic visitation. However, international spend is still higher (almost double) than domestic and remains a growth opportunity in all markets post-COVID.

Want more data on these travel hotspots? Click here to download the full PDF.

Interested in seeking more consumer behavior insights to help grow your business? Explore Moneris Data Services.

Disclaimer: This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed.

About the data: Year-over-year growth volumes are based on a comparison of the week listed to the equivalent week in the year prior. Moneris spending reports measure spending in Canada across a range of categories by analyzing credit and debit card transaction data. The figures and percentages cited are derived from aggregated transaction volumes being processed by Moneris in the applicable categories.