Online shopping comes with the ease and flexibility to browse through products from multiple places while comfortably sitting in one. But can it compare to the in-store shopping experience where you can see, feel, and physically touch the products? How has the dynamic shifted during the pandemic and what it all means for the future of Canadian businesses? Let’s dive in to find out.

In partnership with Moneris® Data Services, the Angus Reid Group conducted a study analyzing the effects of the pandemic on the Canadian apparel industry to see how it shifted the balance of in-store and online spending. Here are the key insights:

1. In April 2020, we saw an almost 90/10 split, implying that the majority of the shoppers shopped online given the pandemic restrictions. As restrictions loosened, the balance began to shift towards in-store. However, in January 2021 when the lockdowns were imposed again, it reinforced online spending with over 70% of people shopping online.

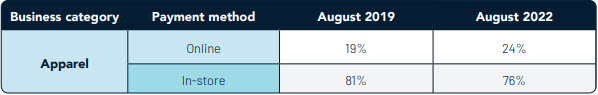

2. The study further shows that the pandemic did leave a lasting impact on how Canadians shop. The share of online spending remains slightly elevated relative to the pre-pandemic landscape. The result is a 5% percent increase in online apparel sales in August 2022.

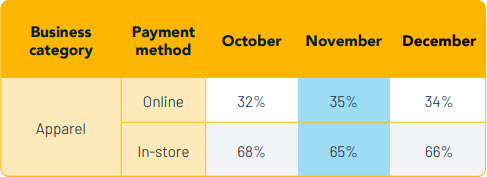

3. With the onset of the holiday season, we’re predicting the share of online spending to increase even further and peak in November and reach a share of almost 35%.

Conclusion

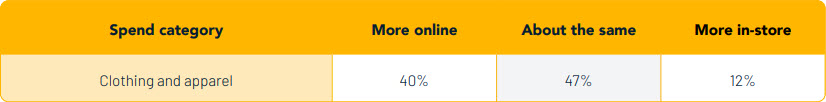

Through all the highs and lows of pandemic spending, Canadians seemed to have found their happy medium when it comes to online vs. in-store shopping. Survey respondents who said their online shopping increased compared to pre-pandemic don’t expect that trend to continue over the next couple of years. When surveyed about spending on apparel, roughly half of the respondents said their online vs in-store mix would remain the same, with some respondents seeing a bit more room for growth online.

Clicks vs. Bricks – Insights on the Canadian Apparel Industry

Checking the math in the aftermath.

When it’s all said and done, the pandemic and its aftermath will have had a massive effect on the spending habits of Canadian shoppers. Using the apparel business category, we can see how the effects of the pandemic shifted the balance of in-store and online spending and examine what it all means for the future of Canadian businesses. By diving into the data, we’re able to answer questions that are top of mind.

- When did online spending peak?

- Will the pandemic leave a lasting impact on online spending?

- What will online spending look like after the year and beyond?

Key Insights

Lockdown, re-open, repeat.

As we’ve come to expect, spending more time at home resulted in a massive boom in ecommerce at the onset of the pandemic. In April 2020 we saw an almost 90/10 split, giving spend majority to online. As restrictions loosened, the balance began to shift towards in-store. However, a January 2021 sequel to the first lockdown would reinforce the online spending advantage with a roughly 70/30 split. The type of industry significantly impacts the share between shopping methods. For example, categories that include essential services may not have experienced as dramatic a shift. Spend is rarely ever entirely in-store or online, being equipped to accept both can help set businesses up for success.

Post pandemic prognosis

While the more dramatic spikes were ultimately short-lived, Moneris’ joint study with

Angus Reid shows that the pandemic did leave a lasting impact on how Canadians shop.

The share of online spending remains slightly elevated relative to the pre-pandemic

landscape. The result is a 5% percent increase in online Apparel sales in August 2022.

Spend data: August split of online versus instore

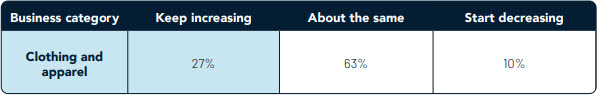

Spend data is also in line with survey data from Canadians as they reflect on changes in their spending habits. Most Canadians felt their spending habits were about the same or skewed towards more online. Very few thought they began shopping more in-store after the pandemic.

Spend data: Results for respondents who selected “more online” Canada

It’s getting colder but online sales are only heating up

With the holidays on the horizon, Moneris is predicting the share of online spending to increase even further and peak in November. Because of the season’s many savings, online spend is expected to reach a share of almost 35%.

Spend data: Forecasted split of online versus in-store for 2022

Online is on the rise

Through all the highs and lows of pandemic spending, Canadians seemed to have found their happy medium when it comes to online vs. in-store shopping. Survey respondents who said their online shopping increased compared to pre-pandemic don’t expect that trend to continue over the next couple of years. When surveyed about spending on Apparel roughly half of the respondents said their online vs in-store mix would remain the same, with some respondents seeing a bit more room for growth online.

Survey data: Compared to pre-pandemic, how has spend changed? Canada

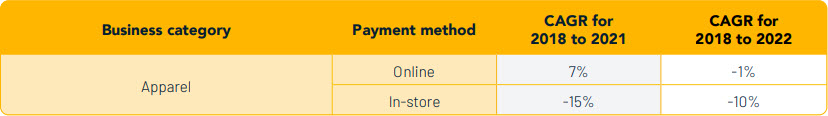

To see how the survey data translates to spending data we can compare the change in compound annual growth rate (CAGR). Looking at CAGR ending during the pandemic (2018 to 2021), Apparel sees online growing at a yearly rate of over 7%, while in-store was decreasing at -15%. Taking CAGR to the present (2018 to 2022), Apparel’s yearly growth online is at -1%, while in-store is now declining at -10%.

Survey data: Comparison of compound annual growth rate (CAGR) ending in 2022 versus 2021

About Moneris

Moneris is Canada’s largest provider of innovative, unified solutions for mobile, online and in-store payments, processing more than one in three transactions. Serving businesses of every size and industry, Moneris offers hardware, software and solutions to help transform the way businesses grow and operate, in payments and beyond.

About The Angus Reid Group

Angus Reid is Canada’s most well-known and respected name in opinion and market research data. Offering a variety of research solutions to businesses, brands, governments, not-for-profit organizations and more, the Angus Reid Group team connects technologies and people to derive powerful insights that inform your decisions.

Data is collected through a suite of tools utilizing the latest technologies. Prime among that is the Angus Reid Forum, an opinion community consisting of engaged residents across the country who answer surveys on topical issues that matter to all Canadians.