Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to provide the retail industry with Canadian credit and debit spending data and consumer insights that will help the industry more easily identify consumer behaviour and spending trends at the national and provincial level.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of December 2023-February 2024)

Overview:

If consumers had a You-Only-Live-Once (YOLO) Holiday gift-giving celebrate-the-season no matter what attitude in December, in January, the proverbial chickens came home to roost, bringing credit card bills and a month of shopping penance with them. Merchants reported, almost uniformly, a solid December, a very weak January, and an improving February. Notwithstanding fitness, storage, and white goods, it is natural for sales to cool considerably in January. Still, we ask retailers to compare year-over-year numbers to understand the relative strengths or weaknesses of results. And they were soft.

The lopsided-upside down weather, El Nino amplified by climate change, has, as discussed in our last report and continued in December-February, given retailers that rely on Canadian seasonality a challenging outlook. Demand for Winter outwear & sporting gear is down, and at this point in the season, many deferred purchases will become lost sales and holding inventories in a warehouse until next season. The trick this season to see any growth with snow and ice products is moving them to the right geography, with cold Winter in the prairies and snowstorms on the East Coast (and the West Coast in Vancouver!) A tentative optimism reflects the sentiment for 2024, more so for the back half of the year than the first two quarters. Retailers’ expectations align with what many economists are thinking about growth in Canada for 2024 – around 1-1.5 percent. Also on a positive note, according to the latest Bloomberg Nanos Canadian Confidence Index consumer confidence is looking positive mid-February after a long period of declining confidence.

Respondent insights for December 2023 to February 2024 MTD

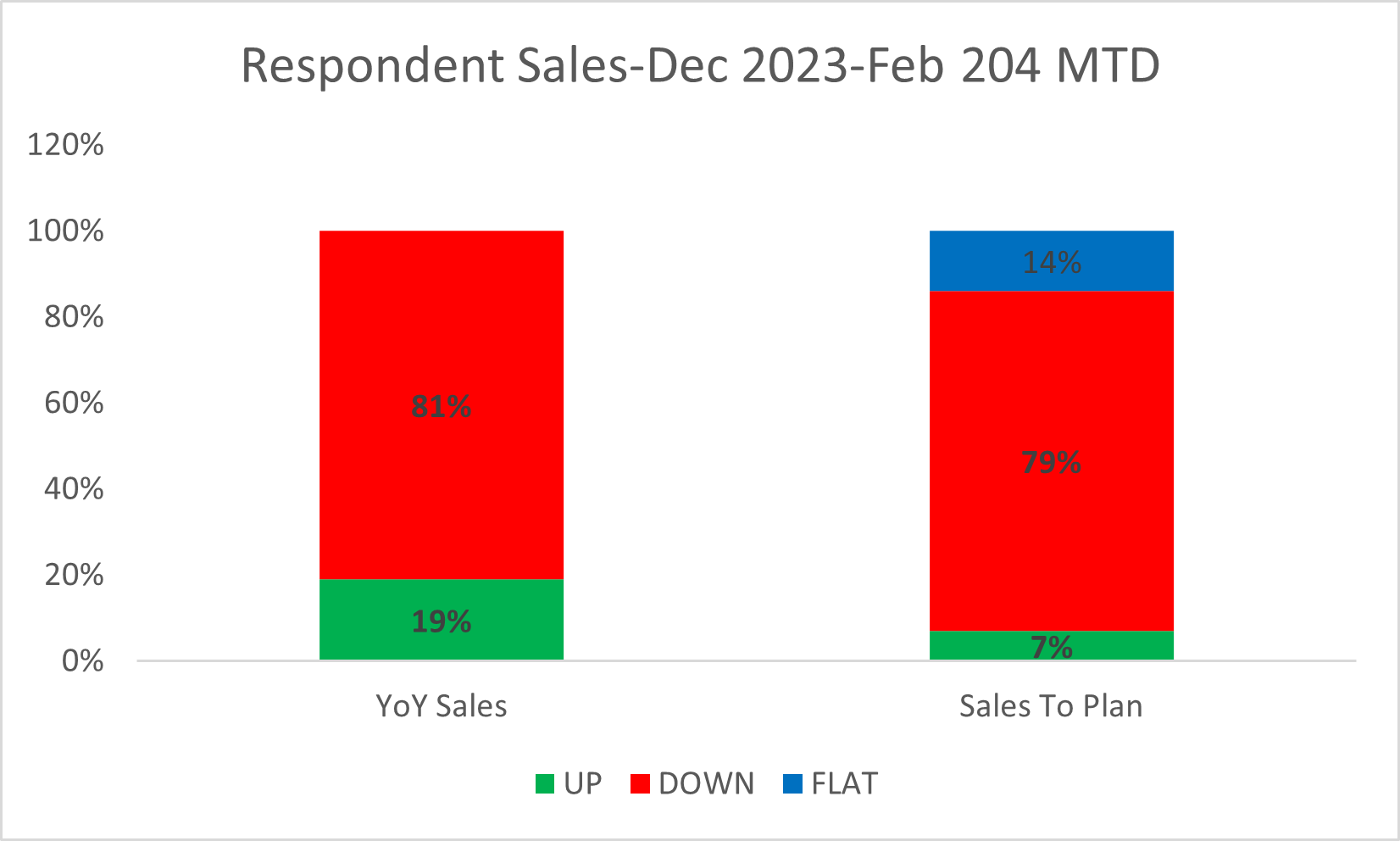

- 81% of respondents reported YoY sales were down across Dec 2023 – Feb 2024 MTD

- 50% said sales across all of 2023 were up vs. 2022, and 44% down.

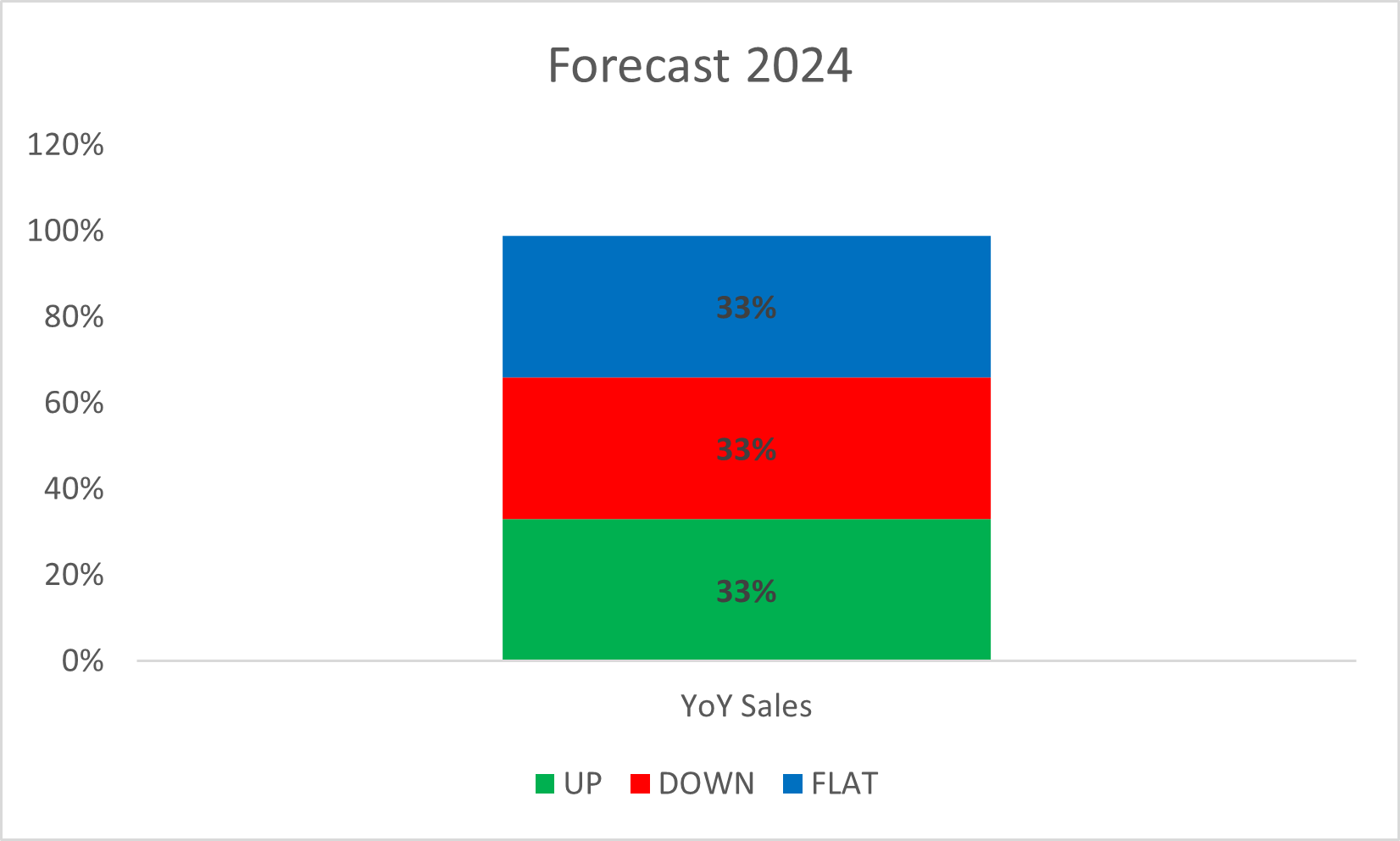

- 33% of respondents forecasted 2024 sales as up, 33% as flat and 33% as down.

- January in-store and web sales were down YoY for 85% and 67% of respondents respectively.

Sales:

Most respondents, 81%, reported sales were softer during this period than at the same time last year.

Retailers report consumers are considerably downshifting their spending in January after a December and overall holiday retail season that met expectations. For many, December was characterized by a slow trough of sales after Back Friday/Cyber Monday and then a final two weeks that stressed their ability to process through all the sales. For those with a sales focus on Boxing Day (week), merchants reported a sales period that mostly met expectations.

Regionally, most retailers reported the Atlantic provinces were a highlight, as well as the Prairies, particularly but not singularly Alberta. Ontario is flat to down for almost all retailers, which is problematic for many retailers with a large percentage of stores in the province. After a few months of solid performance with their eCommerce sites, traffic, conversion, and sales are almost uniformly flat or mostly down for those retailers we spoke with. Some of this performance loss is a focus by consumers on the stores, but certainly, there is erosion from pure-play competitors. Supply chain costs and complexities are back on the boardroom table, with the Red Seas crisis impacting container rates globally. Retailers report significant percentage increases in supply chain costs, with a doubling of container rates.

Fortunately, container rates were quite reasonable heading into the crisis, so the increase comes over a low base. Also, due to an excess in container and global shipping capacity, the higher prices are not sticking. The movement of goods from that part of the world, now re-routing around the Suez Canal, is creating product delivery delays. Finally, there is the risk of CN rail job action this week that could snarl rail traffic here in Canada.

Perspective 2023 & Forecast 2024

Winter 2024 Respondents were almost evenly split on 2023 performance vs. 2022, with 50% saying 2023 was better and 44% saying 2022 was better. Respondents were evenly split on their sales forecasts for 2024: 33% up, down, or flat.

Notwithstanding a rough start, retailers we spoke with are projecting modest year-over-year single-digit gains for 2024, basically in line with macroeconomic growth projections for the nation. On the one hand, this may seem out of step with the prevailing narrative, but that narrative needs to include that mileage may vary amongst different retailers and retail formats. There is no question, as written in several editions of the report, that many retailers continue to feel the impact of the “Great Buy Forward” of certain consumer goods, as well as the ongoing pullback of the Cash Flow Consumer shopper, plus the large segment of the population paying increased rent and higher monthly mortgage rates.

Counterbalancing these impacts on discretionary spending and driving thoughtful, essential spending is the much-documented positive elements of the economy: the Canadian economy added 37,000 jobs in January, giving us a 5.7% unemployment rate (reflected in comments from retailers that hiring remains a top challenge), there are millions of new Canadians with spending power and a segment of older consumers benefiting from higher house valuations and the impact of higher interest rates on their savings.

The State of Work and Workplace Culture

Starting the new year, we wanted to check in with retailers regarding their work arrangements for head office or store support staff. Since the early days of the pandemic in March 2020 that sent office employees en masse to work from home, retailers have been adjusting to their employees’ new work patterns and their own culture and trying to meet the demands of prospective new hires. We first asked about work structures. There continues to be a broad spectrum of philosophies and work environments. For some, office workers returned quite quickly to being full-time office workers.

Hiring remains a challenge for all retailers responding, regardless of their work structure, but more so for those looking for their employees to be in the office full time. The trade-off is familiar: small(er) market, less access to talent. All said that the structure of the office workplace was a leading topic of discussion in prospective employee interviews.

Culture

Many mentioned that their thoughts around workplace structure were in some ways influenced by the reality of their stores and warehouses, where anything but in-person attendance was not considered. A gulf has always existed between the 5-day-a-week office support and 7-day-week front-line teams, but this can be more pronounced in a hybrid work environment.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2,3 million Canadians working in our industry. The sector annually generates over $91 billion in total compensation. Core retail sales (excluding vehicles and gasoline) were over $501B in 2023. Retail Council of Canada (RCC) members represent more than two-thirds of core retail sales in the country. RCC is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, we proudly represent more than 54,000 storefronts in all retail formats, including department, grocery, specialty, discount, quick service, independent retailers, and online merchants. www.retailcouncil.org.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. The sector annually generates over $78 billion in total compensation. Core retail sales (excluding vehicles and gasoline) were over $433B in 2021. Retail Council of Canada (RCC) members represent more than two-thirds of core retail sales in the country. RCC is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, we proudly represent more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants. www.retailcouncil.org.

Contact:

Santo Ligotti

Vice President, Marketing and Member Services

RETAIL COUNCIL OF CANADA | CONSEIL CANADIEN DU COMMERCE DE DÉTAIL

sligotti@retailcouncil.org