Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to provide the retail industry with Canadian credit and debit spending data and consumer insights that will help the industry more easily identify consumer behaviour and spending trends at the national and provincial level.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of September-November 2023.

Overview

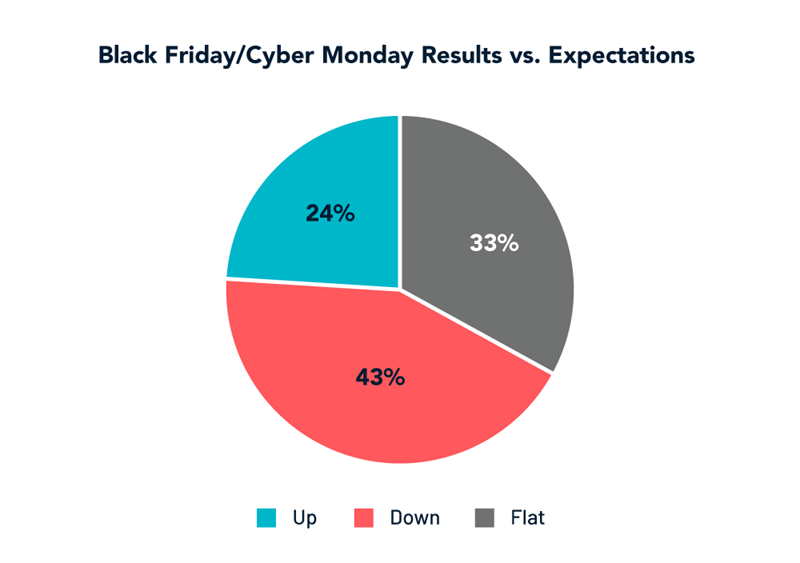

Fall for most retailers finished off a bit stronger than they were projecting during our conversations in early September, but that says little, as expectations were low after a weak start to Back-To-School. October was mostly soft. An early Black Friday/Cyber Monday in the calendar likely suppressed sales early in November, causing some trepidation, but on the whole, retailers stuck to their plans, anticipating this scenario. Overall, the Black Friday/Cyber Monday retail event met or exceeded expectations. The Friday and Monday could have been more spectacular, particularly Cyber Monday, but the overall event taken in its entirety delivered.

We continue to see “cash flow” shopping by a large segment of customers who find value in what they can afford or justify spending daily, weekly or week-to-week. This same segment prioritizes basics and essentials over discretionary purchases, notably bigger ticket discretionary spending – but to a large percentage of Canadians, gift-giving is essential.

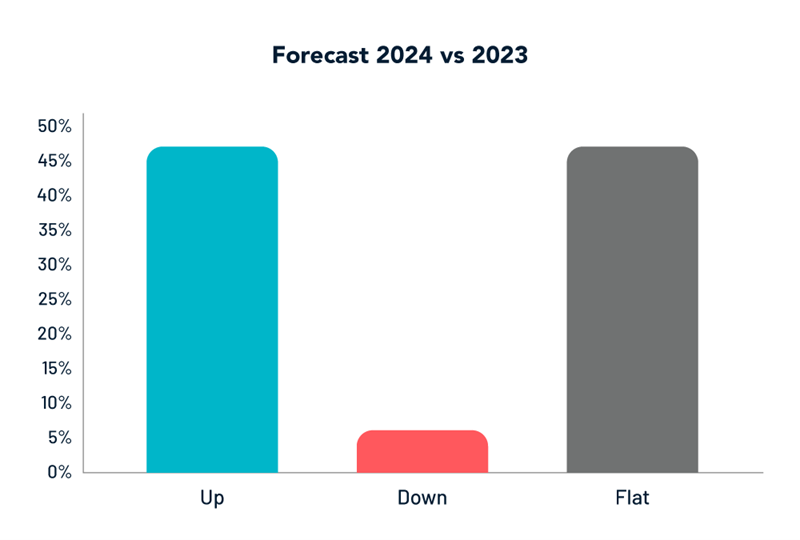

Unseasonably warm weather on the Prairies is significantly impacting sales for winter apparel and winter-related goods, disappointing some retailers in a region that at last is a stand-out sales performer in the country, notwithstanding El Niño. As retailers turn their minds to 2024, almost all retailers were flat-to-up in terms of Year-Over-Year sales, encouraged by the estimated $ 30 billion in spending by the 1.5 million new Canadians as they get settled across Canada, and continued strong employment numbers. The counter-narrative, the “chicken-little” scenario for 2024-2026, is the estimated 20% of all discretionary income that could be hoovered out of the retail economy as Canadians renew their mortgages at current higher interest rates. This scenario, of course, would be very bad for the retail industry.

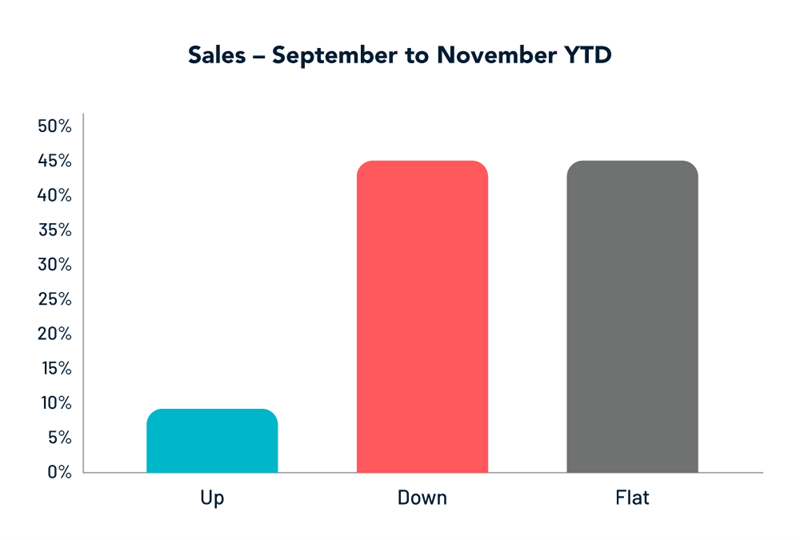

Highlights from September 2023 through November 2023 Month-To-Date• Sept-Nov sales were split for respondents: down for 45% and up for 45%

• Sept-Nov sales were down to plan for 75% of respondents.

• Black Friday/Cyber Monday met expectations for 33% and exceeded expectations for 43%

• 50% of respondents forecasted 2023 to be down to 2022.

• 63% of respondents reported November web sales were up.

• November margin percentage was down for 55% of respondents.

Sales

The Retail Conditions survey is akin to a quarterly roundtable with retail executives from categories other than grocery, gas and auto, conducted in one-on-one confidential conversations, which are reflected anonymously in the Retail Conditions report.

We suggest that those looking for robust retail metrics are advised to also consult Statistics Canada, Moneris and Environics data in RCC’s Retail Pulse Dashboard. Respondents were mixed on the overall survey period, which was September to November YTD: 45% reported sales were up, 45% reported they were down. The RCC Pulse Dashboard, which uses card purchase data across retail to provide an advance proxy sales metric, indicates overall sales were mostly up over last year until the most recent data available, a week or so before Black Friday/Cyber Monday (includes inflation).

Forecast

For our final report in 2023, we asked retailers, knowing what they know today, where they will wind up for the year according to their budget, prior year, pre-pandemic and looking ahead to 2024.

Most retailers we spoke to were down to plan. The question we often heard back to us when we asked about results was, “Which plan?” It has been a dynamic year for all the reasons we have chronicled over the past three reports. The swings are less comprehensive than during the COVID-era of retail. Still, it does point to a planning environment that rewards agility and a broad viewpoint of domestic economic and geopolitical events.

Consumer Behaviour

In-store Customer Behaviour

Consumers continue to favour the physical store experience. Still, as told to us by the merchants and reflected in the Environics data from the Dashboard, traffic is soft for most retailers who continue to consider their location options, as many downtowns still have not reclaimed the kind of week-day office worker traffic that they saw in 2019. Mall traffic can be uneven. Interestingly, retailers report that their sales through one-hour couriers to urban consumers have exceeded expectations.

Web Customer Behaviour

Online sales came back online in the fall. 63% of respondents reported higher web sales in November than last year and 56% reported web traffic was up. This is in line with the sharp uptick in late-October web visits across retail on the RCC Pulse Dashboard, which members can configure to show web traffic data for specific retail categories including accessories, clothing, grocery, online shopping and several more. A reminder that eCommerce sales as reported by Statistics Canada are increasingly problematic. The survey used to compile the data asks retailers in Canada what they sell, so not what consumers are buying online, so it misses retailers selling direct into Canada from China (for example)..

Black Friday and Cyber Monday Retail Events

Overall, the BF/CM retail event met or exceeded expectations for most, but certainly not all, retailers. Respondents were also mixed on BF/CM (Nov 24-Nov 27), with 43% reporting it exceeded expectations, 33% reporting it was flat to expectations and 24% reporting that it underwhelmed. Expectations, of course, are quite a different metric from sales results. Many complaints and realities about this promotion remained true in prior, average (non-pandemic) years. Business softened before the week/ long weekend, and suitably motivated consumers to share a significant percentage of their holiday spending in stores or online. As retailers told us heading into the event, aggressive discounting and pricing strategies are table stakes if you want to make a mark on this promotional event. Some other observations:

• In the cycle, this Black Friday came early in the month, creating a quicker lull in early November but leaving four weekends of shopping before the 25th, so retailers are looking for a solid finish to the marathon that is the Holiday Season. There is enthusiasm and expectations for a strong Boxing Day week.

• For those retailers where the event fell short of expectations, it was a mall and online traffic shortfall. Expected gains from online during Cyber Monday did not materialize.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. The sector annually generates over $78 billion in total compensation. Core retail sales (excluding vehicles and gasoline) were over $433B in 2021. Retail Council of Canada (RCC) members represent more than two-thirds of core retail sales in the country. RCC is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, we proudly represent more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants. www.retailcouncil.org.

Contact:

Santo Ligotti

Vice President, Marketing and Member Services

RETAIL COUNCIL OF CANADA | CONSEIL CANADIEN DU COMMERCE DE DÉTAIL

sligotti@retailcouncil.org

Interested in membership, then please visit retailcouncil.org or contact membership@retailcouncil.org